Red flags of a DRS Scam

Coming across bombastic deals would surely capture our eyes and will spark an irresistible urge to enquire about the services offered.

Ever since the COVID-19 pandemic, scammers are becoming more rampant with their various tactics which led to a lot of victims losing their money at the click of a button. Recently, VIV Associates is aware of ongoing Debt Solution scam messages that are circulating through Facebook Ads.

Scammers normally have poor word choices in their advertisements.

It’s a norm to have an assumption that Singaporeans wouldn't fall for such a ploy. But however, figures have shown otherwise. In 2021 itself, the total number of reported crimes increased by 11.2% to 19,444 cases, from 17,492 cases in the same period in 2020 due to a rise in scam cases.

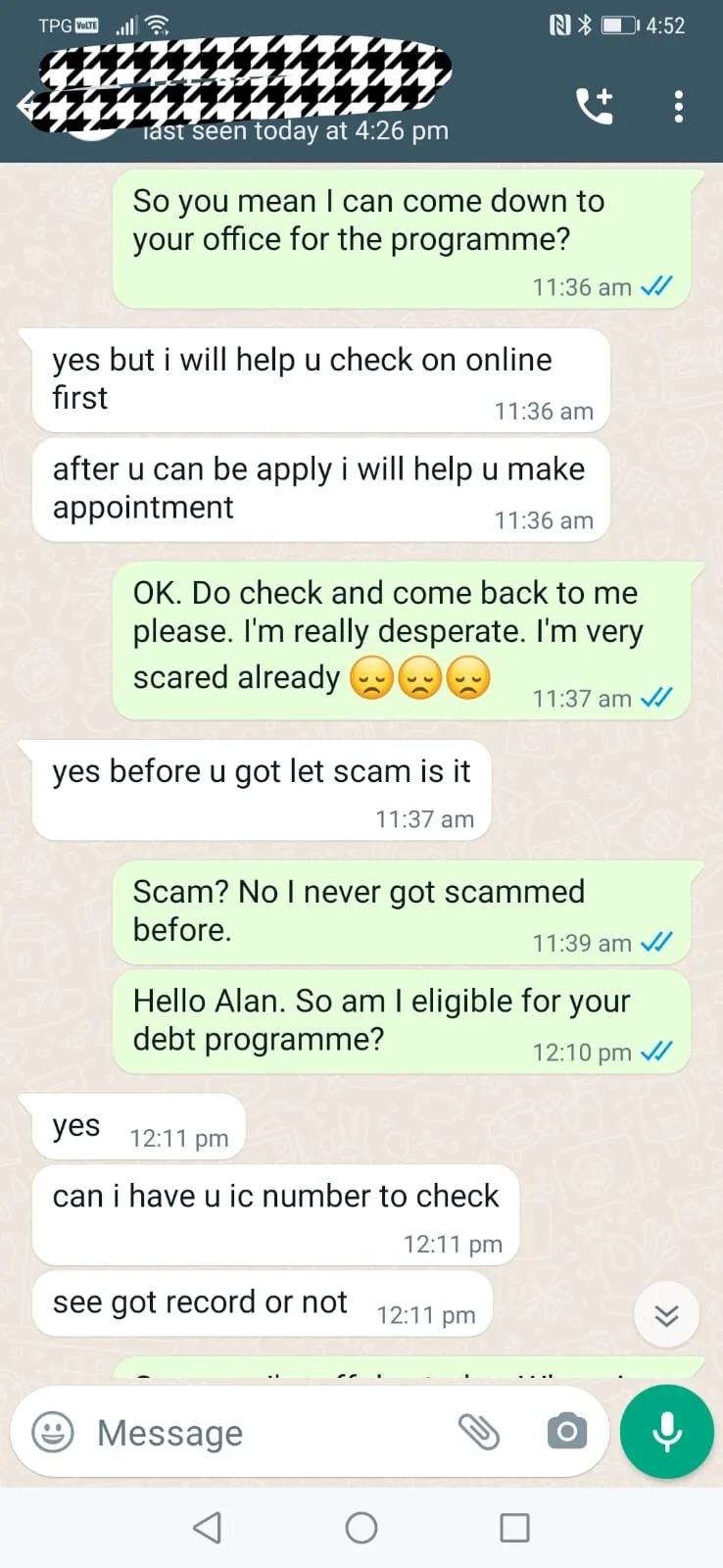

We got one of our team members to get behind the screen as someone who is enquiring about the Debt Repayment Scheme (DRS) with a potential scam Facebook Page “Lend Pro”. A guy named Alan attended to the questions shortly after making an inquiry. In the appended screenshot, you can see that he is asking the total amount of money currently owed, before getting to know the programme.

However, things got really fishy when he started to offer loans in order for them to get started on the Debt Repayment Scheme (DRS) journey.

Redflag #1: Providing loans under Debt Repayment Scheme (DRS)

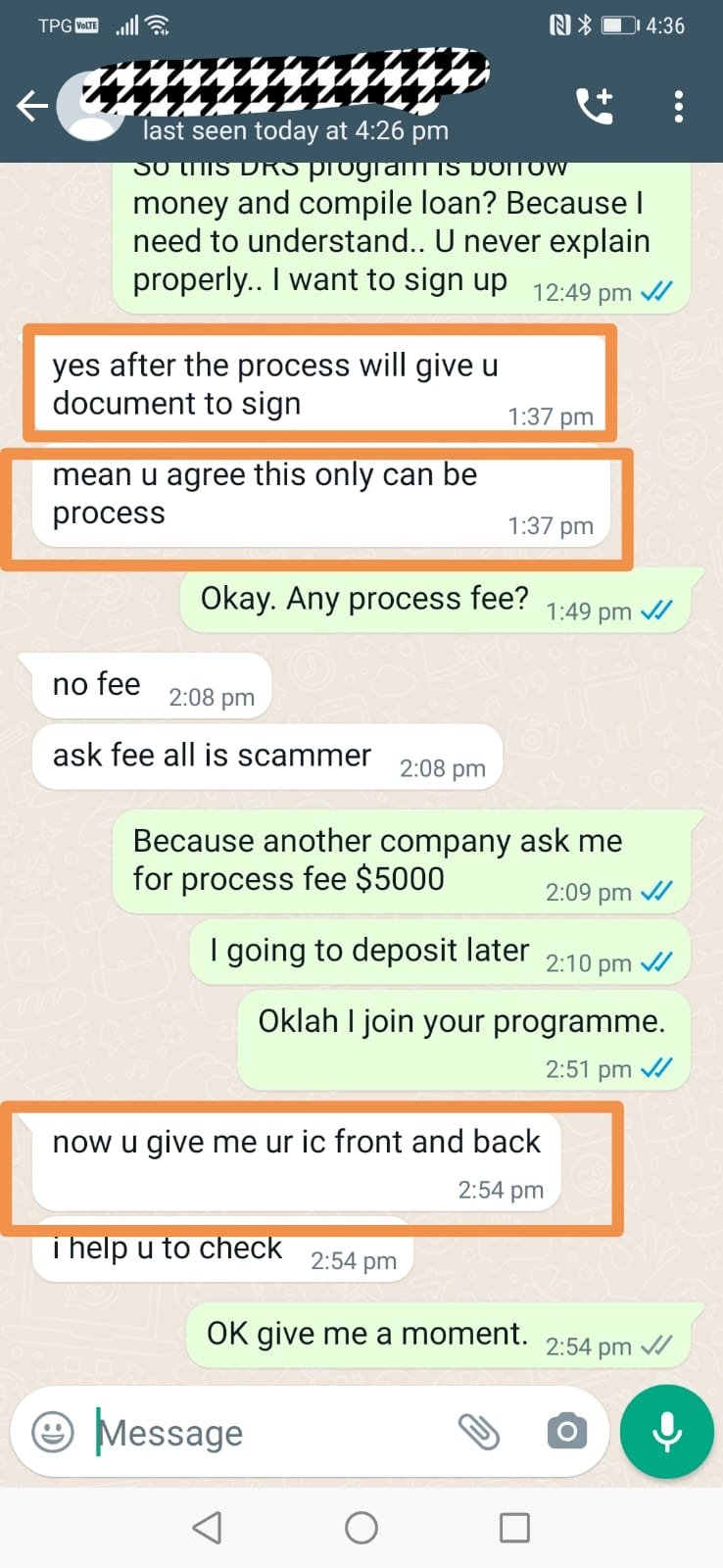

Our team member then preempted Alan saying that the debt is currently below $15k and asked if it is still eligible for Debt Repayment Scheme (DRS). He mentioned that the amount is too small to enter the programme and proposed another programme which requires borrowing money and asked for an identification number.

#RedFlag 2: Asking for your IC

We tried to twist the conversation to divert back on the Debt Repayment Scheme (DRS) topic by asking if we were to combine debt with “our spouse” and hit $15k and if we are still eligible for the programme. He then proceeded to ask how much we need to loan again.

RedFlag #3: Asking you to take loan to settle debts.

Through our findings, we hope that everyone will be much more careful about what you’re getting yourself into.

As scammers won’t sit still and continue to evolve with different cunning tricks, keeping abreast with online scams from time to time is important to avoid falling for it. You can do this by going to www.scamalert.sg to learn more about potential scam traps.